- SolanaBins

- Posts

- what to do before trading memecoins

what to do before trading memecoins

(i wish someone had told me)

this is going to be...

THE most in depth, beginner friendly guide, you've ever read on becoming a profitable memecoin/crypto trader

i’ve spent countless hours in the trenches—learning, failing, and eventually winning. now, i’m handing you everything i’ve learned, all in one place, so you can skip the mistakes and start printing faster.

why traders lose

let’s be honest. you’ve probably done nothing but lose in this memecoin/crypto space.

you’re either buying too late, getting rugged, or missing the coins you should’ve bought. i know because i was there too.

heres the thing…

trading memecoins isn’t some get rich quick scheme.

it’s a skill. you have to learn it. you have to lose so many times until you’re unphased by losing. finally start to get a grip, make consistent wins, figure it out, become profitable and THEN you might have a CHANCE at making it.

but here’s the truth…

even though you’re losing all your money in memecoins right now..

if you’re reading this, you’re already in the top 10% of people IN THE WORLD. 90% of people don’t even read the things they BUY, much less the things given to them for free.

they just want shortcuts.

but you’re different.

i believe with my whole heart you can and will make it in this game.

so let’s get into it.

here’s how to actually become a profitable memecoin trader.

the 7 keys to winning.

there are seven keys to winning with memecoins.

if you're missing even ONE of these keys, forget about making money.

and here’s the thing…

you don’t even have to be right all the time.

in fact, you could be wront 8 out of 10 times, but those 2 wins would cover your losses plus so much more.

so here’s the first key.

spend time scanning.

this might sound obvious, but if you want to find 100x’s, you need to be locked in. you NEED to be chronically addicted. every free second should be spent scanning the market with dexscreener.

dexscreener is a real time platform for tracking and analyzing coins.

and you need to be tracking coins 24/7.

waiting in line? dexscreener.

using the bathroom? dexscreener.

laying in bed? dexscreener.

in church? dexscreener.

forget what people say about not being on your phone. the best traders are on their phones every second possible.

why?

because they don’t want to miss the next runner.

you think you’re any different? you think you can just do less than average work and get better than average results?

think again.

if the best of the best are working non-stop, what do you think that means for you?

lol.

if you want to be great, matter of fact, even DECENT, then you need to find a trader who's profitable - and then do TWICE as much as them. this market is cutthroat. it's a zero-sum game. somebody wins, somebody loses. no in-between. every time you trade, you're competing with the best.

you're competing against people like me willing to give up everything and spend 15+ hours a day trenching.

and that’s where most of you fail. you think you can just mess around, buy a coin, and then get mad when you lose money.

no shit you lost money.

your competition is out here grinding 15 hours a day

scanning.

buying coins.

tracking wallets.

this is just the reality. they will eat you up and spit you out EVERY. SINGLE. TIME.

but here you are… mad at someone else because they told you to buy a coin that didn’t print.

but the only person to blame for your failures so far is YOU.

couldn’t be me. LOL.

get better. scan more

on to the next key.

set up wallet trackers

setting up wallet trackers.

aside from actually showing up, this is the most important, revenue-generating task you can do.

track successful wallets.

you need notifications on when successful wallets bid.

you need to know when they buy. so you can check the ticker yourself, analyze it, and see if it’s worth buying yourself. who knows you might be looking at an early runner. all from tracking what someone else is doing. no labor required.

and if you’re tracking multiple wallets and notice more than one wallet buying the same coin… what do you think that means?

its probably a good coin.

it’s probably gonna moon.

but here’s the problem. most people just wanna set up a copytrade bot, copy every move these wallets make, and expect to print money…

wtf?? have you lost your mind?

this might sound contradictory to my short-form videos. but let’s be real—if i told you the actual truth about wallet tracking upfront, would you have even paid attention?

no.

you would've scrolled away.

wallet tracking is a TOOL.

something you should USE. not depend on.

nothing more.

there are traders out there 100x better than you.

why be ignorant and ignore the chance to track them? to see EXACTLY what they’re doing?

in no other industry is this even possible.

but before you can track wallets, you have to find wallets worth tracking.

spend AT LEAST an hour everyday trying to find more wallets. this is the highest leverage thing you can do.

here’s how to FIND good wallets

go to dexscreener.

filter by highest volume in the last 24 hours, then click on a coin

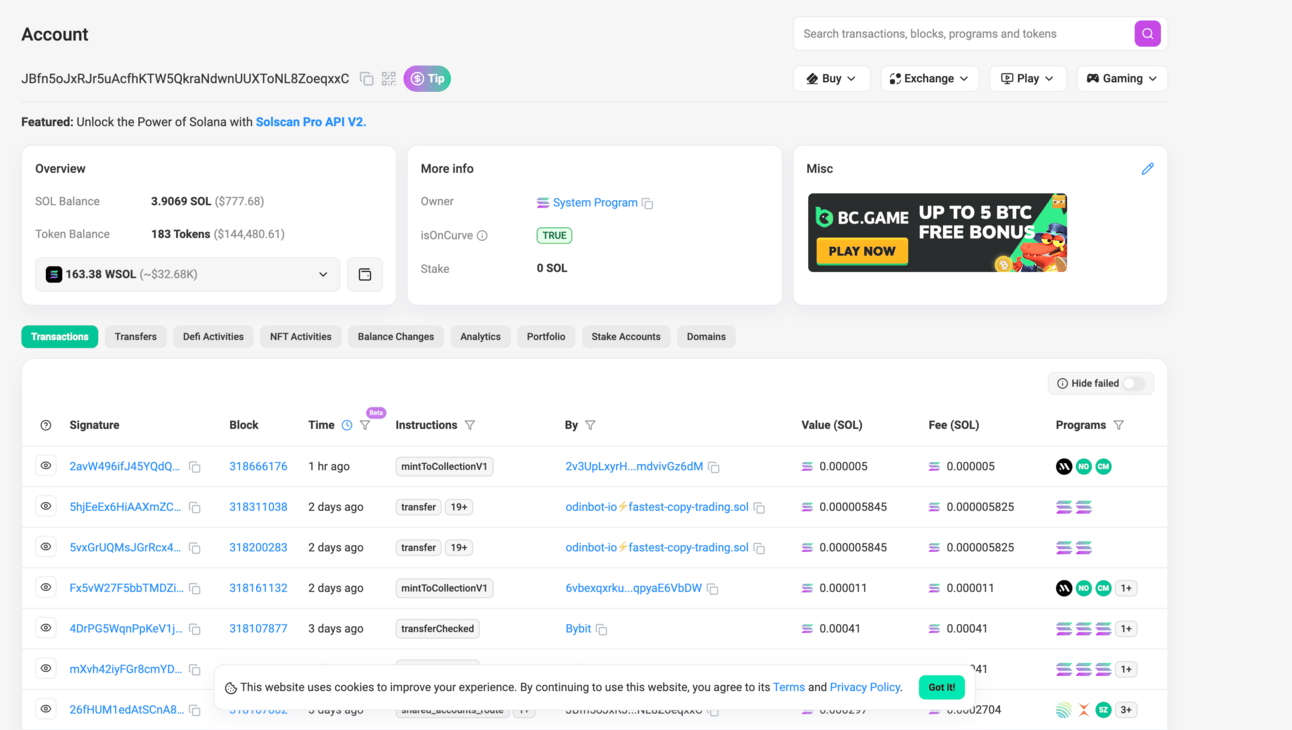

scroll down to ‘top traders’ at the bottom (it’ll look slightly different on mobile, but you’ll find it). see picture below

once you’re in the top traders section - find a PROFITABLE TRADER. what they bought will be outlined in red. and green for how much they sold.

click the square to the right of the green numbers. this takes you to solscan where you can copy their wallet

copy their address at the top left of solscan, next to the purple and green icon. then paste it into GMGN or Cielo.

look for:

an average trade duration of a few hours or a few days

60%+ win rate 7-day P&L

don’t go above 85%—too many people are probably copytrading them.

repeat this process DAILY for 30 mins to an hour. this is crucial. while tracking. over time, you’ll find solid wallets worth following.

checking if coins are worth buying

what i’m about to tell you is super important and a MUST DO before you buy anything.

half of you mf’s hear about a coin and just ape in without even thinking. just because someone else told you to? like what??

then when it rugs, you’re mad at everyone except yourself.

lol.

so how do you check if coins are worth buying?

here is the first thing i do to see if a coin is worth buying.

i check the dev’s profile.

if the coin came from pump.fun, you can always check the dev’s profile.

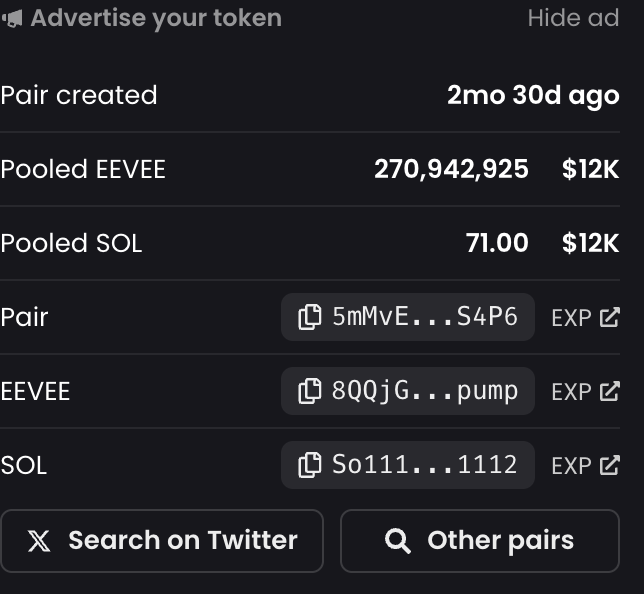

to know if a coin is from pumpfun, look at the ticker on dexscreener (bottom right). if it ENDS with 'pump', it’s a pumpfun coin.

here’s what to do:

copy the token address

paste it in pump.fun

click the dev profile at the top left (see picture below, its got the yellow background at the top left)

check the previous coins the dev has created. if they did well, chances are the dev knows what they’re doing, and their next one might do well too

check if their past coins rugged, if so. avoid the dev.

here’s a quick tip:

pro tip: NOT EVERY COIN THAT GOES TO 0 IS A RUG.

people love to scream ‘rug! rug!’ just to cover up their shitty trading. instead of owning up to placing a bad trade, they blame the project. 99% of y’all do this. it’s ridiculous.

you know who you are.

back to the letter..

on dexscreener, there’s usually a link to their twitter (X). go look at it.

while on the twitter, here are some things to check:

has the account been renamed?

scammers reuse the same twitter, rename it, slap a gold checkmark on it, and rug it.

is the account active?

do people follow it?

are people interacting with the account?

if the X account has been renamed, DO NOT BUY. bad habit. not worth it.

use usersearch.ai to check if the account has been renamed before.

check the community & facts.

if the coin looks good so far, type the coins ticker into the X search bar.

format matters:

if it’s 6 letters or less, it starts with ‘$’ (ex: $WAVE)

if it’s 7+ letters, it starts with ‘#’ (ex: #WAVEBLUE)

what to look for:

is the community active?

any valuable info about the coin?

are KOLs shilling it?

if it’s a scam, people will call it out fast—this can save you a lot of money.

check for dupes.

before you buy, search the name in the dexscreener search bar.

things to check:

has this coin been created before?

is this the original?

if it was created way back and is being relaunched, it’s probably not worth buying. it dumped before, and it’ll likely dump again. otherwise, there wouldn’t be another version.

how to find the real one:

check the liquidity across all versions.

the one with the highest liquidity is the original 99.9% of the time.

if you’re in a race against time, always buy the one with the highest liquidity.

get on X (formerly twitter).

you shouldn’t just be scanning dexscreener—you need to be scanning twitter too.

what to do:

follow key influencers

turn notifications on

these KOLs will tweet coins they think will send. most of the time, they’re right. and they also know way more than you, so if they’re shilling a coin, it’ll pump regardless.

here’s a list of top KOLs on X:

lyxe

tethegamer

_shadow36

daumeneth

solnorsey

dior100x

0xuberM

rektober

moneyl0rd

these guys are some of the best legit KOLs for lowcaps. you NEED to have their notifications on.

be on X at ALL TIMES.

don’t get your crypto info from youtube.

those guys are clueless and only care ab XRP.

use a crypto twitter tracker.

this is one of the MOST IMPORTANT things you can do. a good tracker monitors key accounts that move the crypto market.

why this matters:

when Trump tweeted his coin, people with CT trackers saw it first and bought immediately.

when Elon Musk changed his X name to keckius maximus, trenchers spotted it fast, aped in, and made millions.

these moments are life-changing. if you’re not tracking, you’re already too late.

we have a tracker in our premium group. if you’re not in there, you’ll have to manually track to the best of your ability. do this by optimizing your ‘for you’ feed on twitter.

create a burner account

follow the influencers above

only interact with crypto tweets

also ask chatGPT for a list of people that could have impact and who you need to follow

don’t topblast… or should you?

this is a big deal. i struggled with this in the past, and honestly, i still do. FOMO is real, and if you give in, it’ll cost you a lot of money.

but…

some of my best trades have come from topblasting, forgetting about it, and letting it ride.

so what should you do?

chances are, you don’t have the vision i do. you won’t spot runners as early. the top of a coin to me isn’t the top of a coin to you.

everyone gets the entry they deserve.

read that again.

you’ll probably topblast much later than the pros, until you get better. so in your case… you need to wait for a dip.

when you see a coin booming, you’re probably thinking:

“it’s not gonna dip.”

“it’s gonna go up forever.”

reality check.

ALL COINS DIP.

even PNUT had a 90% retrace after it pumped. people bought the dip, rode it back up, and printed. if you know a coin is strong, and there’s just sell pressure, wait for the dip.

how do you know when a coin is gonna reverse?

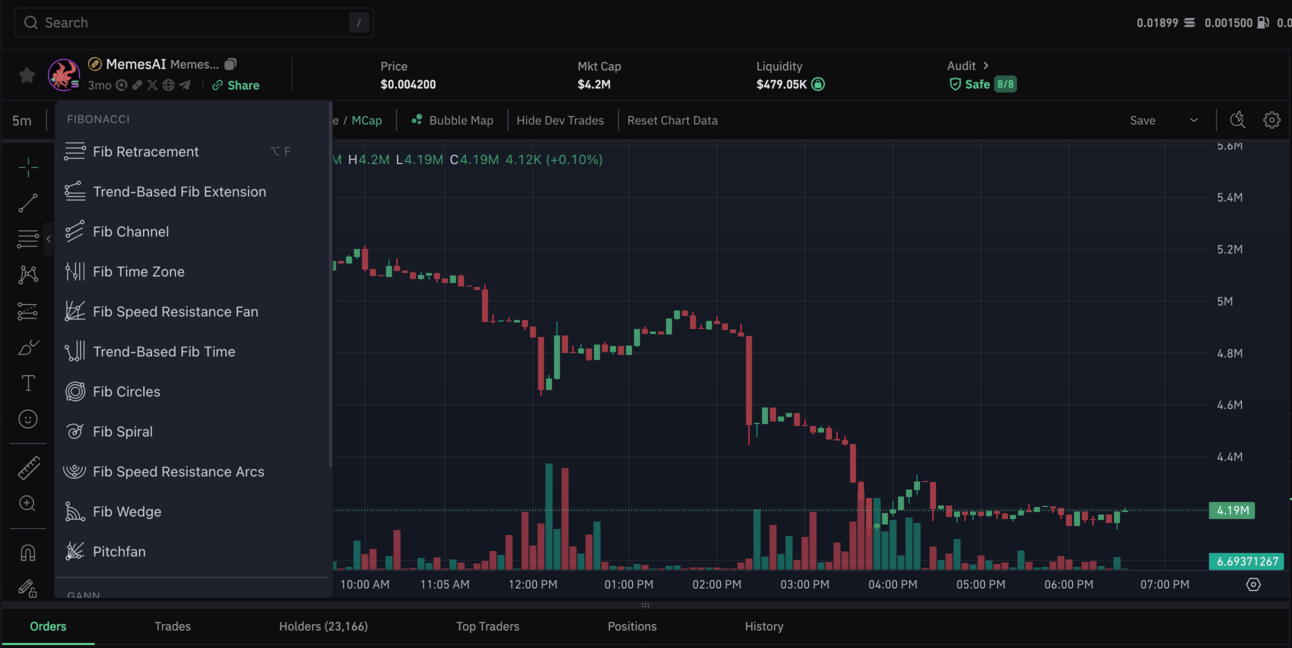

most traders use fibonacci levels. they’re like checkpoints where prices tend to bounce.

key fib levels:

23.6%

38.2%

50%

61.8%

78.6%

i personally watch .618 and .5 because they’re where prices usually bounce.

when GIGA dipped in the picture above, it didn’t just drop randomly. it bounced perfectly at .618. that’s not a coincidence.

the universe is weird, i know.

to find these levels:

click on the fib retracement tool. its usually on the left side of the screen on all trading bots (see pic above)

place the first level at the lowest point before the pump

place the top at the highest point before it starts going down

this creates levels that show where price might pull back and bounce

if you pair a fibonacci level with a support level → even better.

some traders only trade fib retracements as their strategy. you’ll figure out what works for you.

when’s a good time to buy?

if price bounces at a key fibonacci level AND

the price makes a higher low

that’s a good entry.

a higher low means price goes up, dips, but doesn’t dip as low as before. this shows buyers are stepping in earlier, which is a sign of strength.

if price retraces to .618 or .5, forms a higher low, and finds support—it’s usually ab to pump. fr.

we love this because it confirms the trend is still bullish. each dip gets bought up sooner, meaning it could pump.

but what if a coin dips more than 60%?

most of the time, it’s dead.

UNLESS it has a super active community.

i could go way deeper into this, but let’s be real… most of you don’t care to hear all this.

but if you do wanna know more about technical analysis let me know. i read every message.